If you’re staring at a heap of receipts and bank statements, wondering where to begin putting things together into coherent accounts, and why you should bother, then this is the post for you.

I’m going to talk you through some of the underlying theories behind how your bookkeeping is organised so that you can get the big picture. This post will not walk you through setting up Xero, QuickBooks, Sage, Wave, Pandle, QuickFile, etc.

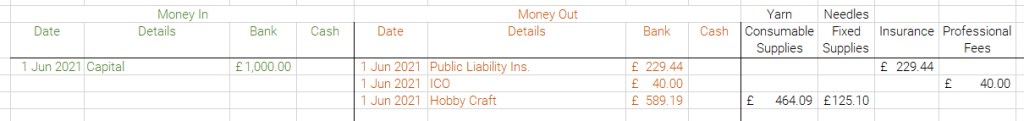

We will, however, have a close look at some fictional bookkeeping by hand to illustrate the ideas. I find it easier to look at how things would be done by hand to grasp the concepts behind what the software is doing for you later on. My handwriting’s gone to pot in recent years, though, so I’ve typed this in Excel so you can read it. 😉

The big idea of how you break down your income and expenses is that you should do whatever will give you useful information to help you make future decisions.

For example, if you’re wondering, “Is this packaging supplier less dear than my current set of packaging suppliers?” then you need to know how much you’re currently spending on packaging. If you make a note of it every time you buy packaging, then you’ll be able to see how much it costs you overall to answer that question. You could (and indeed should, periodically) go one step further and subtract the value of the packaging you have on hand, so that you know how much packaging you’ve used. You could even divide that by the number of sales so that you could work out the average packaging cost per sale. Then you’ll be able to look at the new supplier, work out their cost per sale, and compare apples to apples.

Read on below, or watch my video on this subject here:

Example

Now let’s look at the nitty-gritty details of how you might handle your first month’s bookkeeping on paper (well, in Excel).

To get started, if you’re doing this on paper, turn it sideways, landscape orientation. You’ll need several columns. Next, the general idea is that you list every transaction that has to do with your business. This will generally be every line on your business bank statement, plus extra lines for anything you paid in cash.

You’ll list Money In on the left and Money Out on the right, with columns for the payment methods you handle.

Let’s assume you put £1,000 of your own money into your business bank account to get your knitting business started. Then you immediately bought in some things necessary to start your business: you paid for insurance, you paid your ICO fee for data protection registration, and you bought some needles, yarn, etc.

List each of these transactions, and then for the expenses, break down what category they fall into off to the right. You can call your columns anything that makes sense to you. You can add to these as you need to, so don’t worry about trying to set up in advance all the columns you might need to have.

You might put all your yarn, needles, stitch holders, etc., together under Supplies, or you might want to break these down into two categories – one for consumables (yarn) and one for things that will stick around for over a year (needles, stitch counters, etc.). If you separate it, then you’ll be able to see at the end of the month, quarter, year, etc., how much you’ve spent on yarn, so you’ll be able to judge better how much you might need to spend next month, quarter, year, etc.

Now let’s say over the next few days, you pay for some software subscriptions, carrier bags for market sales, and boxes for shipping your website sales. You probably want to add a column for Software Subscriptions now.

You could put your bags and boxes together with yarn in your Consumable Supplies column, or you could make a new column for Packaging. It’s up to you. Again, it depends on what might be useful information for you later on. If you think you might want to compare other suppliers’ costs to your current suppliers, you probably want these separated. So let’s make a new column and put our carrier bags and boxes there.

If you wanted to, you could even separate that further into one column for Packaging for Markets and another for Packaging for Website Sales. Again, give some thought to what will be most useful for you later on.

Hooray, you’ve made your first sales! The income goes on the left, for Money In. They were website sales, so the money was paid into your bank account. You’ll put them in the bank column. The whole value that the customer paid will go on this line.

There were some expenses for them as well, though: there were payment processing fees, and you had to pay for the postage to ship them. You can see that we’ve needed to add columns for these. If you had other fees, you’d note them down, too, and potentially add columns for them as well.

As an aside, if you are shipping orders, you’ll want to keep track of how much you’re spending so that when your sales volume increases, you have the numbers you need to compare the various couriers. You’ll also want to keep track of how many parcels you’re sending. Here are a few ideas for doing that:

- The easiest thing might be to simply note that in its own column here if you’re actually setting this up.

- You could keep a list on a fresh spreadsheet, showing simply the date and number of parcels shipped. Then you’ll be able to sum it by week or month.

- If you’re using accountancy software, you could enter each item of postage as a line item separately, and then count the number of line items of postage you’ve had.

Now you’ve been to a couple of markets over the weekend, made some sales, hooray, and paid for some expenses. The sales go in the Money In columns, just as the website sales did, but now you’ve had some cash taken in, too, so you’ll note how much of each you had.

The expenses are shown here in orange again, and then you put them in their respective columns off to the side. We haven’t had market stand fees or parking before, so we’ve added columns for those.

And now, at the end of the month, you’ve calculated your mileage for travelling to the post office plus those markets, so you enter that. You’ll pay this from your business bank account to your personal bank account, reimbursing yourself for the expense.

The monthly bank fee has been charged to your bank account, which really doesn’t fit in any of the other expense columns, so we’ve added a new one. As an aside, I really hope you aren’t paying fees for your bank account in your first month: usually, you can find offers for fee-free business accounts for several months. MoneySavingExpert usually has a good round-up of business bank accounts.

So! Now that it’s the end of the month, you might add up all the columns to see how you’re doing. This has become a bit hard to read – do click to enlarge the photo.

Now what?

What might you do with these figures?

You might check to ensure your bank balance is correct and no mistakes or fraud have happened there. The totals of the bank columns say £1,585.00 in and £1,316.89 out, so you should have a balance of £268.11 in your bank account. If not, check to see if you’ve overlooked a transaction or miscategorised it on your spreadsheet.

You might like to know how much you need to pay regularly every month, whether you make any sales or not, so that you can see if you have that much in your bank account to cover those costs. For that, you’ll want to total your Software Subscriptions and your Bank Fees. The knitter in our example needs £56.18 to cover their regular monthly outgoings.

The insurance in this example was an annual fee, though if in reality yours is paid monthly, then you’ll need to add that, too. The ICO fee is annual, but if you have other professional fees that are monthly, you’ll need to add those, too. The knitter in our example has a further £269.44 in annual fees, so they may wish to set aside £22.45 each month to save up for those expenses next year.

If you’ve used up all your yarn on the sales you’ve made this month, then you can also look at how much your Consumable Supplies versus your Sales are. Our knitter spent £464.09 on yarn to make £800 worth of goods for sale. Thus, 58% of the price of each item is the yarn itself. Whether that’s a good proportion or not depends on the rest of the overheads and expenses, as well as how much time each piece takes to create.

A question you might need to answer at times is, “What can I trim to reduce costs?” Instead of pouring through hundreds of lines on your bank statement, you can look at the columns first, automatically ruling out some expenses, so you don’t waste time looking closely at those transactions. It also helps you see where you can get the biggest return on your time spent doing this: start with your dearest expense types and work your way down. It’s not really going to save you, on balance, if you cancel a £10/month software subscription but spend 1000 hours putting its alternative into place. Even if that lasts 3 years, that’s still the equivalent of 27 hours per month – and your time is more valuable than £0.37/hour.

Another question you might like to answer is “Was it profitable to trade at Chisworth Market?” or “Have I made a profit on the website sales?” The numbers above are necessary to answer those questions (but the exact process is beyond the scope of this blog post).

Translating to Accountancy Software

So now you’ve seen the nitty-gritty details for how you’d set up your accounts on paper or in Excel. When you set up your accountancy software, you’ll see the columns across the top that you used to break down your expenses are presented as a list called a Chart of Accounts.

To the right is the first part of Xero’s default Chart of Accounts. Just as we changed and added columns as we went in the example above, the Chart of Accounts in your accountancy software will need to be changed to suit your business.

- Some of these accounts/categories match the ones in our example above, such as Bank Fees.

- Some are different names for the same thing – Cost of Goods Sold is going to be your Yarn.

- Some are entirely unnecessary for our knitter at the moment: as a self-employed person, they have no Direct Wages to pay. They’ve also not paid for any advertising or marketing yet.

- And some of the columns our knitter used aren’t showing at all, and will need to be added in (if they aren’t further down the screen). Make your software work for you – any software you ever use – to give you what you need. Don’t think you must use whatever’s there when you open the account and only those. What’s there is just a suggestion.

The Big Idea

Hopefully, this post has helped gel the big idea in your head. You keep accounts to see the breakdown of how your money enters and leaves your business. Then you can make informed decisions when questions arise.

Any questions? Do ask in the comments or email me.